Blog

Crexendo And Digerati: Ride The Cloud To Growth With These Undiscovered UCaaS Stocks

Summary

- The Unified Communications-as-a-Service (UCaaS) market is evolving at an incredible pace.

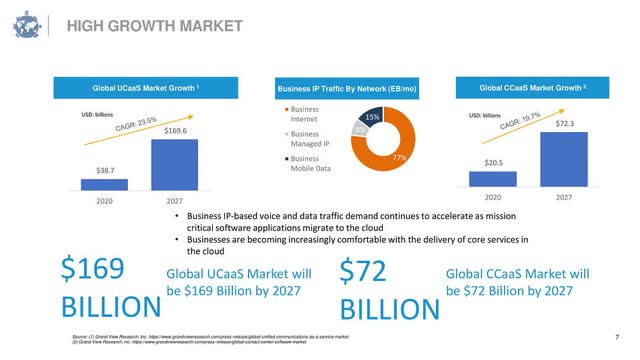

- The global UCaaS market projects to expand from $38.7 billion at a CAGR of 23.5% through 2027, reaching a value of $169.6 billion.

- Remote work is driving UCaaS growth faster than ever as the pandemic accelerated the shift to remote working.

- Approximately 75% of small to medium-sized businesses (SMB) or twenty million SMBs in the U.S. have not yet migrated to a Voice-over-Internet (VoIP) solution.

- These two undiscovered publicly-traded UCaaS companies target the underserved SMB market.

Investment Thesis

There is a groundswell of migration from legacy on-premises communication systems and networks to cloud-hosted communication applications. All investors should incorporate UCaaS stocks in their portfolios to take advantage of this explosive growth opportunity.

While many UCaaS companies have matured, there are still a few promising undiscovered UCaaS providers positioned for significant growth but still trading as undervalued stocks. To gain exposure to the fast-growing UCaaS market, investors should look at DTGI and CXDO. Both companies have the potential to put up double-digit organic growth numbers and potentially triple-digit growth performance through targeted acquisitions in the UCaaS sector.

Digerati (OTCQB:DTGI) and Crexendo (NASDAQ:CXDO) are two publicly traded UCaaS companies offering attractive value, growth, and price appreciation potential based on their lower multiples and market cap as compared to their pure-play UCaaS peers, and anticipated positive news flow expected in the coming weeks and months.

Both companies focus on the massive SMB market primed for accelerated growth. By focusing on the low-hanging fruit as opposed to competing with larger competitors for the same large enterprise accounts, both companies compete and win this business. Both companies offer trusted local service providers a menu of highly sought-after UCaaS solutions demanded by their end clients. These clients are very loyal to their local cloud communications provider because they offer high-touch personal services that larger competitors cannot provide. This is a distinct advantage both growing companies have over larger UCaaS competitors

In the past twelve months, both companies have achieved exceptional growth through accretive acquisitions that are contributing to improved margins, increasing revenue, and profitability. Their stock prices are undervalued and should begin to rise as more news is released and investors realize the potential of the businesses.

I am initiating coverage on both companies with a Strong Buy recommendation and building a long position in each company. Due to compelling market drivers, and recent and expected news from both companies, I believe now is the perfect time to “Ride the Cloud” with these two undiscovered cloud communication stocks.

Overview

Digerati Technologies, Inc. (OTCQB:DTGI), and Crexendo, Inc. (CXDO), offer investors a unique Ride the Cloud growth opportunity in the unified communications-as-a-service, remote work, and SMB digital transformation markets. As Crexendo explains in its Investor Presentation, released September 9, 2021:

It’s Never Been a More Perfect Time” to be in the UCaaS business. We call it “Ride the Cloud” because our business and the UCaaS industry are forecasted to grow to new heights. Invest in a rapidly rising future.”

Indeed, the UCaaS market is evolving at an incredible pace. According to the Grand View Research report, the global unified communications-as-a-service market was valued at USD 38.74 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 23.6% from 2021 to 2028, reaching a value of $169.6 billion. Remote work is driving UCaaS growth faster than ever as the pandemic accelerated the shift to remote working. As a result, most companies are planning a move to cloud-based communications.

Crexendo and Digerati are well-positioned providers of cloud services specializing in UCaaS solutions for the small to medium-sized business market. Their cloud communication product lines are in high demand as businesses migrate from traditional phone systems to cloud-based telephony systems. According to Digerati, an astounding 75% of SMBs or twenty (20) million SMBs in the U.S. have not yet migrated to a cloud-based Voice-over-Internet (“VoIP”) solution.

Both companies are on a path to accelerated growth and profitability through different strategies and organic growth initiatives. However, the companies were extremely comparable. Prior to Crexendo’s acquisition of NetSapiens, the companies had remarkably similar top-line revenue at $15 million and projected adjusted EBITDA at $1.5 million. Nonetheless, Crexendo stock traded at a much higher multiple and market cap closer to its pure-play peers.

Crexendo stock uplisted to the Nasdaq this year and recently closed an $11.7 million net proceeds stock offering that oversubscribed. Crexendo also announced its own plans to use proceeds to execute an acquisition strategy to complement its strong organic growth.

Currently, Digerati lists on the OCTQB exchange, which poses more risk. However, it offers much more upside potential as recent filings seem to indicate that the SEC provided a “no-review” letter response, setting up DTGI for its own up listing to the Nasdaq soon. When combining the imminent announcement of an uplisting, a reverse split, and Digerati’s year-end results expected before October 31st, 2021, I anticipate DTGI to easily double or triple from its current trading range of $0.11 cents per share. I expect strong results showing outstanding growth and continued profitability. DTGI holds the best prospects for significant upside that should match the run already seen in Crexendo as it went from the OTC to the Nasdaq.

In this fiscal year, Digerati engaged Maxim Group to advise and execute Digerati’s uplift, closed two acquisitions, achieved profitability, and established a $20 million credit facility to accelerate its acquisition strategy.

Recent SEC filings include the “Information Statement Pursuant to Section 14(c) ”. The 14(c) outlines the company’s corporate actions necessary to successfully complete its uplift from the OTC to the Nasdaq. The actions include adopting a reverse stock split and changing its name to “Nexogy, Inc”, which is the name of the largest company DTGI acquired this fiscal year. The S-1 filed on August 11, 2021, shows an anticipated $10 million equity offering planned in a simultaneous transaction with DTGI’s uplisting to the Nasdaq. These board and shareholder actions accomplish key factors for a successful uplisting. The actions (i) provide fresh capital to pay off an upcoming debt obligation and finance future acquisitions, and (ii) help the company meet or exceed all the Nasdaq and SEC requirements for an uplisting.

A successful uplisting to the Nasdaq will provide DTGI with more valuable equity and liquidity. A Nasdaq stock acts as an attractive currency to attract and close more acquisitions in the future. A larger portion of an acquisition purchase price paid in equity instead of expensive venture debt is a more favorable structure.

All these filings lead me to believe Digerati can successfully complete its uplift from the OTC market to the Nasdaq exchange in the immediate weeks or months ahead.

The UCaaS & CCaaS Market

Expert research and CPA firms make compelling cases supporting their projections for anticipated growth in the UCaaS and Cloud Communications & Collaboration markets. The rollout of 5G and 8k video streaming will strive to meet the insatiable demand for voice, data, and video content as dictated by business customers and consumers. This demand is rising at an exponential rate. Such demand creates a significant need for dependable, high-quality, and fast connectivity and communications. UCaaS and Call Center-Communications-Platform-as-a Service (CCaaS) providers will be in high demand to satisfy this unprecedented growth.

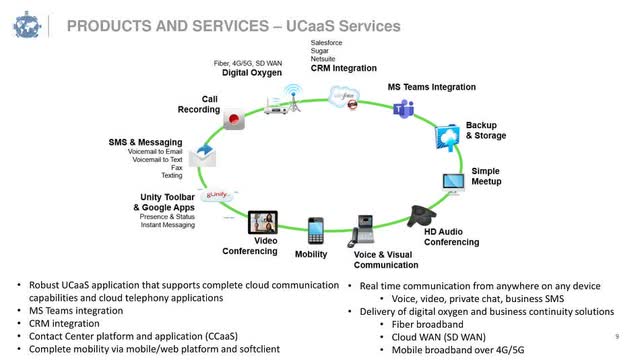

UCaaS Products & Services

Digerati and Crexendo sell Unified Communications-as-a-Service solutions primarily to SMBs. UCaaS brings VoIP, video conferencing, instant messaging, and collaboration tools together on one platform that is hosted in the cloud.

Competition

Both companies’ primary competition comes from the large telecom carriers, Verizon, AT&T, and T-Mobile, traditional PBX vendors, as well as large national UCaaS providers such as Ring Central and 8×8. By targeting the vast SMB market, both companies take business from carriers who provide less personal attention and poor customer support. These larger competitors typically experience difficulties moving down into local markets where SMBs are loyal to their local communications service provider. Therefore, most of these large competitors tend to focus on larger enterprise accounts. The largest UCaaS providers in order of size are: BroadSoft owned by Cisco, Metaswitch acquired by Microsoft last year, Mitel (private), and moving up to number four is now Crexendo due to its recent acquisition of NetSapiens. Then there are hundreds of regional and local players providing services in limited geographies.

Crexendo

Long-term investors in Crexendo have experienced outstanding gains. On October 1, 2018, CXDO stock was trading for $1.66 on the OTC exchange. Now, just three years later, CXDO is trading on the Nasdaq exchange for $6.04 per share. That is a gain of 364%, far outpacing gains of all major indices during this time span. CXDO popped over $9 per share in the few days following its uplisting to the Nasdaq on July 8th, 2020.

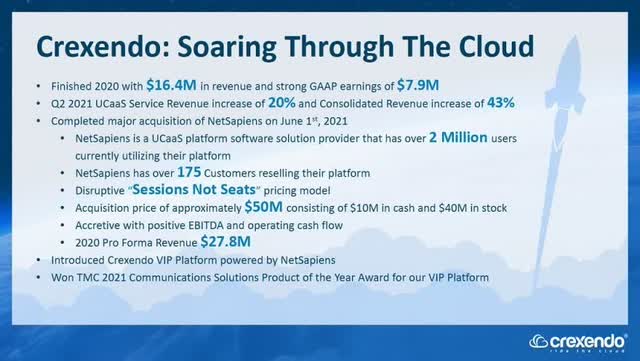

CXDO has been through a remarkable transformational year ever since. Following its uplisting, CXDO announced on September 20, 2020, the closing of a follow-on stock offering at $5.50 per share raising over $11 million in fresh capital. This offering placed a solid floor on the stock. On March 8, 2021, CXDO announced a Definitive Agreement to acquire NetSapiens, Inc.

NetSapiens is an award-winning, patented, leading UCaaS platform delivered via a high availability network. It is available on a subscription or a purchase model. At the time of CXDO’s acquisition, they supported over 1.7 million users on their platform through a community of service provider partners. Launched in 2002, NetSapiens’ goal was to deliver next-generation IP-enabled communication apps to service providers. In 19 years, NetSapiens grew from zero service providers to 200+ service provider customers serving 2 million end users today. Since the closing of the NetSapiens acquisition on June 1, 2021, their end-user base has grown over 17%.

Crexendo – Now a Leading UCaaS Wholesaler

It is important to note that NetSapiens is a wholesaler of UCaaS products and services leaving room for their local communication service providers to mark up the products and services in the retail environment. NetSapiens has experienced impressive growth because everyone in the ecosystem is making good margins and enjoys profitability.

CXDO made an excellent acquisition in NetSapiens. It cements CXDO’s position as a leading contender in the wholesale UCaaS business. The powerful combination of the IT teams of each organization creates tremendous competitive advantages. Their dependable 100% uptime carrier-grade network and price points allow them to battle it out with the large well-funded incumbents and new entrants for larger enterprise accounts if CXDO chooses to go after such enterprise accounts.

CXDO Joins the Russell Microcap Index

On June 15th, 2021, CXDO was included in the Russell Microcap Index effective June 28, 2021. Membership in the Russell Microcap® Index means automatic inclusion in the appropriate growth and value style indexes. FTSE Russell determines membership for its Russell indexes primarily by objective, market-capitalization rankings, and style attributes.

Stock Performance

Despite all the good news and momentum, the stock has traded down from its peak settling in a narrow range just above its 50-day and 200-day moving average. Considering the acquisition-related costs, and only one month of post-acquisition earnings contributions from NetSapiens to review, impatient investors have depressed the stock. This may be disappointing to short-term traders, but it is a buying opportunity for long-term investors looking to Ride the Cloud for growth and profits. When the full weight of the contributions from the NetSapiens acquisition kicks in, and impressive double-digit organic growth continues, the stock should be able to reach new highs.

On September 9, 2021, CXDO filed an 8k Investor Presentation with the following highlights in its new investor presentation.

Financials

On August 10th, 2021, CXDO announced its Q2 2021 earnings report. CXDO saw a total revenue increase of 43% to $5.8 million. Service revenue increased 20% year-over-year to $4.3 million. Non-GAAP net income was $37,000 and GAAP net loss was $(1.0) million.

Financial Results for the six months ended June 30, 2021

Crexendo’s second quarter of 2021 was greatly impacted by the acquisition of NetSapiens. Total revenue for the six months ended June 30, 2021, increased 30% to $10.3 million. Service revenue for the six months ended June 30, 2021, increased 20% to $8.5 million. Revenue from the NetSapiens business combination contributed only 30 days of results. Operating expenses for the six months ended June 30, 2021, increased 71% to $12.4 million compared to $7.2 million for the six months ended June 30, 2020. Acquisition-related expenses accounted for $1.1 million of the additional general and administrative expenses. Acquisitions also contributed $2.4 million of the additional operating expenses.

For the six months ended June 30, 2021, CXDO reported a net loss of $(1.7) million or a $(0.09) loss per diluted common share, compared to a $648,000 net income, or $0.04 per diluted common share for the six months ended June 30, 2020. The net loss is attributed to acquisition-related costs. The company should return to double-digit growth and profitability as the integration of NetSapiens is complete and cost benefits are fully realized.

Total cash, cash equivalents, and restricted cash on June 30, 2021, were $7.9 million.

Balance Sheet

CXDO ended the second quarter with $7.9 million in cash, $1.95 million in working capital, and $3.008 million in debt. CXDO’s total assets have grown from $22.26 million on September 30, 2020, to $78.28 million for the second quarter of 2021. Common stock equity has grown from $16.18 million to $65.21 million over this same period. Based on the recent performance of management, I expect CXDO to continue to create shareholder value through careful financial growth-driven management.

Market Cap

Since September 30, 2019, CXDO’s market cap has steadily grown from $44.87 million to its current $130.43 million.

Management

Crexendo has a strong and experienced management team. Both the CEO and President are long-time telecom executives with extensive experience growing companies and sales.

Risk/Reward

I believe CXDO stock has a stable floor of $5.50 per share. The stock should regain upward momentum upon releasing future reports including the accretive contributions from the NetSapiens acquisition or any positive news flow related to new business, organic growth, or an announcement of another acquisition.

The primary risk I see is the possible risk of service provider pushback on CXDO competing directly in markets where potential new service providers compete. With the NetSapiens acquisition, CXDO is a leading UCaaS wholesaler. CXDO also continues to engage in direct sales efforts at the UCaaS retail level. This duel faceted structure creates a potential conflict. Is CXDO a technology provider focused on the wholesale market serving service providers? Or, alternatively, is CXDO a UCaaS solutions provider engaged in direct sales in the retail market? The answer is still not clear to me. Although I expect the company could create proper protections in the form of account leads and management rules. Such rules can function as a clear chinse wall between the wholesale and retail businesses to eliminate the possibility of any conflicts.

Digerati

Digerati is a cloud communications service provider offering UCaaS and carrier-grade networking solutions to its customers. The experienced Telecom management team is laser-focused on the execution of its stated roll-up acquisition strategy targeting local communications service providers with revenue between $2 million to $10 million and positive EBITDA. These local providers serve a significant number of SMB end-users migrating their communications to the cloud. The industry is still highly fragmented offering many prospective targets for acquisition. The team and strategy are venture-backed by Post Road Group, a private credit, and private equity firm, with $1+ billion invested. Post Road enables DTGI to successfully complete future acquisitions with prearranged financing terms.

Long-term investors in DTGI have experienced a ride from $0.27 cents on October 1, 2018, to a low of $0.02 cents in March 2020, early in the pandemic during the overall market sell-off. Then, the stock went back up to $0.22 cents on March 15, 2021, after announcing impressive growth due to its acquisitions. The stock has drifted back down to $0.11 cents per share on little news and low volume. However, the current stock price provides an attractive entry point for investors that will not last long.

Financials

I have analyzed Digerati’s latest quarterly report filed by the company on June 10th, 2021, for the quarter ending April 30th, 2021. The company reported an increase in revenue of 140% to $3.751 Million for the Third Quarter FY2021. A gross profit of $2.225 Million, and a strong gross margin improvement to 59.3%.

FY 2021 Nine-Month Results

The first nine months of 2021 were greatly impacted by the two acquisitions of Nexogy and Active PBX during this period, more than doubling revenue and catapulting the company to profitability.

Post-acquisitions, quarterly revenue growth more than doubled and the total number of customers increased from 731 on April 30, 2020, to 2,612 customers by April 30, 2021. DTGI management expects organic growth of 5-10% going forward. For the nine months ending April 30, 2021, revenue grew 83% to $8.6 million versus $4.7 million. Gross margins were 59% versus 50% the year before and management expects continued improvement with continued cost reductions and synergies from acquisitions. I’m projecting continued gross margin improvements in the 62% -64% range.

Income Statement Annual Pro Forma Analysis

| Digerati Technologies Inc. | 12 months, reported | Annualized Per Q3 Pro Forma | |||||

| consolidated income statement in $m | 31-Jul-2018 | 31-Jul-2019 | 31-Jul-2020 | ||||

| Revenue | 2.0 | 6.0 | 6.3 | 151 | |||

| Cost of services | (1.1) | (3.1) | (3.0) | (6.1)2 | |||

| Gross margin | 0.9 | 2.9 | 3.2 | 8.9 | |||

| SG&A | (3.6) | (4.6) | (4.7) | (8.8) | |||

| D&A | (0.2) | (0.7) | (0.6) | (2.4) | |||

| Operating profit (EBIT) | (2.9) | (2.4) | (2.1) | (2.4)3 | |||

| Interest expense | (0.5) | (2.2) | (1.3) | (49.4)4 | |||

| Tax | 0.1 | (0.0) | 0.0 | (0.00) | |||

| Net income EBITDA Revenue growth Customer count Average revenue per customer per month Gross Margin SG&A as a percentage of Revenue | (3.2) (2.6) NA 622 268 | (4.6) (1.7) 202% 702 717 | (3.4) (1.5) 4% 728 719 | (51.8) 0.1 139% 2,612 4795 59% 59% |

- 1) Revenue has hit a run rate of 15.0m. This is above our 14.0m target

- 2) Gross margin is trending at 59%

- 3) Operating Loss increased, despite the increase in gross margin. This is attributed to higher legal fees, SG&A, and depreciation.

- 4) Loss on derivative instruments was $10.878 million for the three months ended April 30, 2021. This is the estimated expense of the Post Road warrants.

- 5) Average revenue per customer (ARPU) has declined significantly “attributed to the Company’s significant shift in its product mix towards UCaaS services upon acquiring Nexogy and ActivePBX”

Balance Sheet

DTGI ended the third fiscal year quarter with $2.125 million of cash and $10.6 million in debt. Its current ratio is only 0.1. Its debt to total assets is 62.2% and its cash flow for the nine months ending April 30, was a negative $1.5 million on an operating basis. Its free cash flow was a negative $11.8 million which includes acquisition-related costs of $10.1 million. For the nine months, adjusted EBITDA was $626,000. DTGI’s total assets have grown from $4.24 million on July 31, 2019, to $17.05 million for the third quarter of 2021. Enterprise Value has increased from $3.69 million on January 31, 2020, to $23.3 million currently. Common stock equity is a negative $14.77 million.

To meet the standard NASDAQ shareholder equity requirements for listing, and based on DTGI’s filing of its S1 on August 11, 2021, I expect the company will complete a capital raise and reverse split to reach the equity and other requirements and raise enough cash to sustain operations to get it through to cash flow breakeven. Based on the recent performance of management, I expect DTGI to continue to create shareholder value through the successful execution of its targeted acquisition strategy.

Analysis of the Latest Quarterly Balance Sheet

| Digerati Technologies Consolidated Balance Sheet in $m | 31-Jul-2020 | 31-Jan-2021 | 30-Apr-2021 |

| Cash | 0.7 | 1.9 | 2.1 |

| Accounts receivable | 0.2 | 0.6 | 0.6 |

| Other current assets | 0.4 | 0.2 | 0.3 |

| PP&E | 0.4 | 0.6 | 0.6 |

| Intangibles | 2.7 | 14.0 | 13.5 |

| Total assets | 4.4 | 17.4 | 17.0 |

| Accounts payable | 1.5 | 1.6 | 1.9 |

| Accrued liabilities | 2.1 | 2.7 | 2.1 |

| Debt | 2.2 | 9.5 | 10.3 |

| Convertible and derivative debt | 1.2 | 7.3 | 18.2 |

| Total liabilities | 7.0 | 21.1 | 32.4 |

| Shareholders’ equity | (2.6) | (3.7) | (15.4) |

| Total liabilities and Equity | 4.4 | 17.4 | 17.0 |

| Net debt (excl. convertible/derivative) | 1.5 | 7.6 | 8.2 |

| Net accounts payable | 3.0 | 3.4 | 3.1 |

| Debt/EBITDA | n/a | n/a | n/a |

| EBITDA/Interest | n/a | n/a | n/a |

- The company has cash of $ 2.1 million and this grew between January and April

- Financial debt has increased somewhat

- In the latest quarter, the Company recognized on its balance sheet the Post Road Warrants as a derivative debt. This resulted in an $ 11.0 million increase in Convertible and Derivative Debt and a consequent decrease in shareholder equity

- Since operating cash flow continues to be negative, the balance sheet shows a high amount of leverage

- To meet Nasdaq listing requirements, the simultaneous offering and capital restructuring proposed with the up listing should ensure that the current negative shareholder equity is positive shareholder equity at a level meeting the standard requirement for uplisting to Nasdaq.

Market Cap

Since January 1, 2020, DTGI’s market cap has steadily grown from $854k to its current $15.86 million.

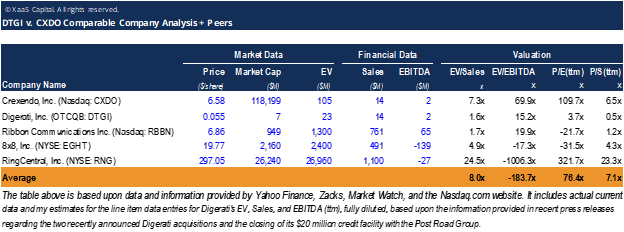

Financial Comparisons

The financial ratio comparisons below indicate that DTGI is trading at significantly undervalued prices because investors, institutions, and research firms have yet to hear their story. DTGI’s EV to Sales ratio is 1.6 compared to all others which are priced by the market at an EV/Sales ratio of 5 or greater. Therefore, I believe, Digerati holds the greatest potential upside for immediate growth and near-term price appreciation.

Any of the positive events and news flow I expect to come out in DTGI’s year-end report before the end of October 2021, and any other positive news to come out shortly thereafter, should send the stock skyward. DTGI’s share price should be brought up to align DTGI within the same valuation range as its peers, based on a correction of the EV/Sales ratio.

Company Comparable Analysis and UCaaS Peers

Source: Steven Highfill, Author, XaaS Capital

A Turning Point for Digerati

DTGI’s Q3 is significant as the first reporting period that includes a full contribution from their Nexogy and Active PBX acquisitions. The prior quarter included only 73 days of contribution. Digerati is reporting attractive headline growth figures based on year-over-year performance. Their annual revenue run rate of $15m is encouraging and appears to be better than previous company guidance of “above 14 million”. A gross margin of 59% is also a good sign. My target going forward is 62% – 64%.

I expect to see more evidence of promised synergies and cost savings realized in the company’s year-end report, expected before the end of October 2021. A good report of continued growth and profitability should send the stock back to new highs in the low $0.20 cent per share range, with the potential to hit $0.30 cents to $0.35 cents per share if the reverse stock split, uplisting, and simultaneous stock offering is announced. Any added news related to organic growth and additional acquisitions could potentially send the stock over $0.40 to $0.50 cents per share. Obviously, these prices will reflect differently if DTGI’s stock is uplisted to the Nasdaq. In such a case, shares could trade from the minimum Nasdaq listing price of $4.50 per share post reverse split and listing on Nasdaq, to as much as $9.00 to $13.50 per share.

If all this potential news plays out as I expect it will, DTGI should be discovered by many more investors and traders as it hits the Nasdaq Capital Market under the new trading symbols “NXGY” and “NXGYW” respectively.

Zacks Small Cap Research Initiates Coverage of DTGI

Lisa Thompson, a respected analyst at Zacks Small Cap Research, initiated coverage of Digerati on August 10, 2021, with a positive outlook and price target of $0.21 cents per share.

The Post Road Overhang

The $20 million Post Road debt facility used by DTGI to finance the two acquisitions will also provide capital for additional acquisitions. The “Post Road Financing” deal was multifaceted. Two important aspects are still apparently an overhang on the stock. Namely the imminent refinancing of Term Loan B and the massive dilutive effect of the warrants issued to Post Road. First, Post Road is a supportive partner firmly behind DTGI’s management and business model. I expect the S-1 filing for the $10 million stock offering occurring simultaneously with the reverse split and uplisting to the Nasdaq will generate sufficient cash to pay off the Term Loan B further cleaning up DTGI’s balance sheet. As for the obvious significant dilution from Post Road’s future exercise of its warrants, these dilutive events are effectively hedged by clawback clauses that reduce their dilutive effect from 25% to just 15% of the outstanding shares. Such events trigging this protection is the imminent uplisting and simultaneous offering. I believe Post Road will be willing to renegotiate more favorable debt financing terms and potentially increase their overall amount of debt financing to help Digerati achieve more acquisitions faster. As a significant equity holder, Post Road’s incentive to see stock price appreciation aligns with management and shareholders alike.

Management

My investment in DTGI is supported by my belief in the experience and capabilities of its management team. This team has extensive telecom and UCaaS industry expertise. They have successfully built companies from the ground up, taking one company public, reaching a $615 million public market valuation.

Risk/Reward

The primary risk facing DTGI is the risk of not successfully completing its uplisting to the Nasdaq or the planned simultaneous offering. However, based on the recent filings presented herein, it appears Digerati will up-list to the Nasdaq and complete its offering in the very near future. I believe DTGI stock has a stable floor of $0.9 cents per share. If the reverse split and uplisting are announced soon, the stock could double or triple from its current price level.

Even if Digerati gets stuck on the OTCQB longer, the relationship with their financial backer, Post Road, will allow the company to continue to make acquisitions and grow revenue and profits. This “Plan-B” provides a hedge against the risk of being stuck on the OTC longer.

Conclusion

Although both companies compete against larger deep-pocket companies, the expected UCaaS market expansion provides plenty of opportunities for smaller companies like Crexendo and Digerati. The share prices of both DTGI and CXDO are set to take off as investors realize the potential of the businesses. Both companies offer investors an opportunity to Ride the Cloud to Growth!

For long-term investors, I recommend building positions in both companies to leverage the roll-up acquisition strategy of DTGI and the wholesale strength of CXDO. For short-term investors, I highly recommend taking an immediate position in DTGI ahead of its upcoming year-end report due before the end of October 2021, and the anticipated announcement of successfully uplisting to the Nasdaq.