Blog

This Company Says It’s A Strong and Growing Competitor in the Cloud Telecommunications Space

Digerati Technologies Inc. DTGI, a provider of cloud services specializing in Unified Communications as a Service (UCaaS) solutions for the small to medium-sized business market, last week announced its financial results for the 3 and 12 months ended July 31, the company’s 4th quarter and annual year end for its fiscal 2021.

View the original post on BENZINGA.com

Digerati Technologies Inc. , a provider of cloud services specializing in Unified Communications as a Service (UCaaS) solutions for the small to medium-sized business market, last week announced its financial results for the 3 and 12 months ended July 31, the company’s 4th quarter and annual year end for its fiscal 2021.

transition-logo

Key Financial Highlights for the 4th Quarter Fiscal 2021 (Ended July 31)

- Revenue increased by 142% to $3.787 million compared to $1.567 million for the 4th quarter fiscal 2020.

- Gross profit increased 170% to $2.360 million compared to $0.875 million for the 4th quarter fiscal 2020.

- Gross margin increased to 62.3% compared to 55.8% for the 4th quarter of fiscal year 2020.

- Non-generally accepted accounting principles (GAAP) adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) income improved to $0.525 million, excluding all non-cash items and one-time transactional expenses, compared to adjusted EBITDA income of $0.062 million for the 4th quarter fiscal 2020.

- Non-GAAP operating EBITDA (OPCO EBITDA) improved to income of $0.910 million, excluding corporate expenses, compared to a non-GAAP operating EBITDA of $0.342 million for the 4th quarter of fiscal year 2020.

“We enjoyed a very productive and successful fiscal year 2021, highlighted by the closing of our acquisitions of Nexogy and ActivePBX,” Digerati CEO Arthur L. Smith said. “We accomplished key objectives related to these acquisitions during FY2021 and now have a strong and significant platform in Florida and Texas that serves as a foundation for continued growth.”

“We will remain focused on targeting annual organic growth of 10% that is complemented by accretive acquisitions as we seek to increase our profitability and enhance shareholder value. With an acquisition financing partner, Post Road Group, that shares our vision for strategic acquisitive growth, we will seek to capitalize on the opportunities in a very fragmented market that has created a healthy pipeline of prospective acquisitions.”

Key Accomplishments:

- With the acquisitions of Nexogy and ActivePBX completed and integrated into its business, Digerati says its operating subsidiary T3 Communications Inc. serves more than 2,600 business customers and approximately 28,000 users. The business model of the combined entities is supported by strong and predictable recurring revenue with high gross margins under contracts with business customers in various industries, including banking, healthcare, financial services, legal, insurance, hotels, real estate, staffing, municipalities, food services and education.

- Digerati closed a $20 million senior secured credit facility with Post Road Group. The facility enables continued expansion of Digerati’s U.S. operations through organic growth efforts and targeted acquisitions. Post Road Group shares in Digerati’s strategic vision of combining organic growth with accretive acquisitions in building a formidable UCaaS provider for the small and medium-sized business market.

- The company entered a strategic partnership with Sandler Partners to expand access to America’s fastest-growing master agent and distributor of connectivity and cloud services.

- Digerati improved its balance sheet.

- Digerati reduced potential equity dilution.

With four acquisitions now fully-integrated and funding secured, Digerati states that it is looking to expand its operations and key areas of expertise further. The company wants to take market share away from competitors such as Ring Central, Inc.

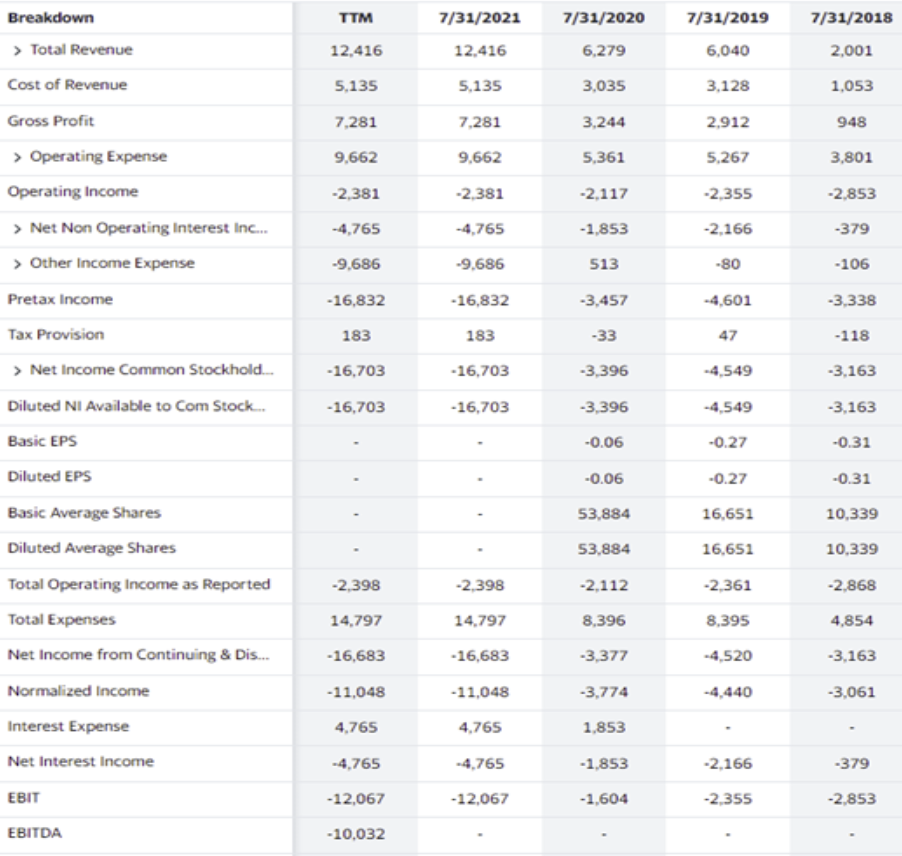

3-Year Income Statement

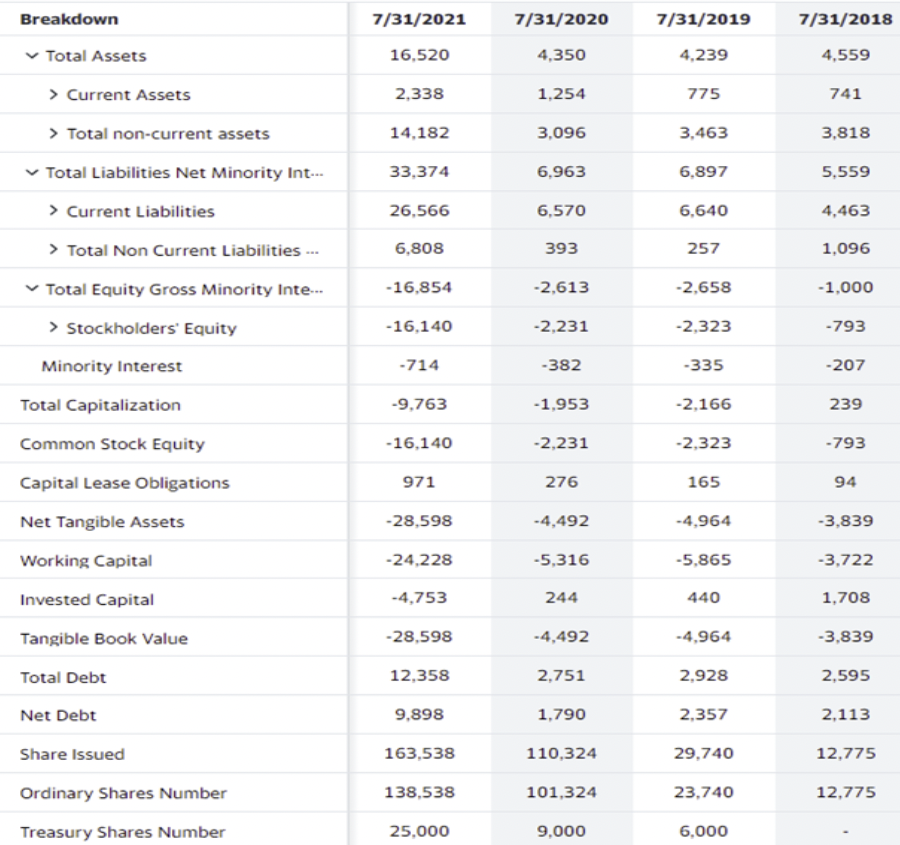

3-Year Balance Sheet

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice